Editor’s note: This article was originally published April 27, 2020 and has been updated several times to adjust with the ongoing guidance from the SBA and recent legislation.

As part of the Federal Cares Act, an initial $349 million was set aside for small businesses — mostly rolled out into two programs: the PPP (Paycheck Protection Program) and EIDL (Emergency Injury Disaster Loan) with EIDL Advance.

While the PPP has now expired, it’s important for any businesses who have gotten it or any support to understand the guidelines and how money can be used. The next phase was passed by Congress and signed by President Trump on Friday, April 24, 2020. This next phase (known as Phase 3.5) of interim emergency relief includes $310 billion for the PPP. As part of the new bill, $30 billion of that is reserved for community-based lenders, small banks, and credit unions while $30 billion will go to mid-sized banks and credit unions.

We’re also approaching the time when banks and lenders who gave PPP loans will open up portals and applications for forgiveness.

It also includes an additional $50 billion for the Small Business Administration’s emergency disaster lending and $10 billion in SBA disaster grants. (Get more details about these and other programs from the CARES Act.)

So what’s next exactly for small businesses? Read on to learn more options for those who are still looking for financial support during COVID-19 and what to do if you were approved for funds.

What if You Still Need Funds for Your Small Business?

While over 1.6 million loans were funded, many small businesses were unfortunately shut out of the first round of PPP funding and are still waiting to hear about EIDL approval as well. The sheer volume of applications from businesses flooded the system, so funds were exhausted in just 13 days.

The second round of funding was just approved and signed by the President, though, so getting in touch with your bank or a lender and compiling your documentation is a good idea so you’re ready since applications seem to be based on a first-come, first-served basis.

Tip: The second round of PPP funds are still available, so make sure to act now if you need financial assistance for your small business.

How Can I Get PPP Funding?

You’ll need to work with your bank or credit union to apply. You can also find approved lenders near you on the Small Business Association (SBA) website. Most banks are prioritizing or only accepting applications from current business banking customers.

Large banks like Chase and Bank of America were the first banks to roll these out, but many local banks are official SBA lenders as well. Additionally, online lenders like PayPal, Square, and Lendio are offering PPP loans, so if and when another round of funding opens up, those could be options to check out as well. You may still be able to fill out applications (online or using the official PPP application) with some lenders to get in the queue now, too, so just check on their website or ask your banking contact.

Using PPP Funds

You should use the proceeds from these loans on your:

- Payroll costs, including benefits; Interest on mortgage obligations, incurred before February 15, 2020;

- Rent, under lease agreements in force before February 15, 2020;

- and Utilities, for which service began before February 15, 2020.

Payroll costs include:

- Salary, wages, commissions, or tips (capped at $100,000 on an annualized basis for each employee);

- Employee benefits including costs for vacation, parental, family, medical, or sick leave; an allowance for separation or dismissal; payments required for the provisions of group health care benefits including insurance premiums; and payment of any retirement benefit;

- State and local taxes assessed on compensation; and

- For a sole proprietor or independent contractor: wages, commissions, income, or net earnings from self-employment, capped at $100,000 on an annualized basis for each employee

How Can I Get EIDL Funding?

You apply through the SBA website, but the applications are currently closed since the funds are out for now. If you’ve already applied, they’re processing funds on a first-come, first-served basis and the SBA is still processing advances. Once the second round of funding, the site should open back up for new applications, so keep an eye out for the official announcement.

What’s the EIDL Advance?

This is the loan advance small businesses receive up to $10,000 ($1,000 per employee) that small businesses receive once their application is processed. These advances are still being distributed if you were able to apply in the first round.

How Do I Follow Up on My SBA Loan Approval Status?

The volume of applications for these programs are at an all-time high, so many small business owners are experiencing delays. These delays combined with the lack of status availability many are experiencing can be frustrating, but it’s important to realize that the SBA is dealing with a never before seen number of loans.

You can try calling to follow-up, but we’ve heard conflicting reports on if a representative is actually able to provide an update. The main phone number to call is 1-800-659-2955.

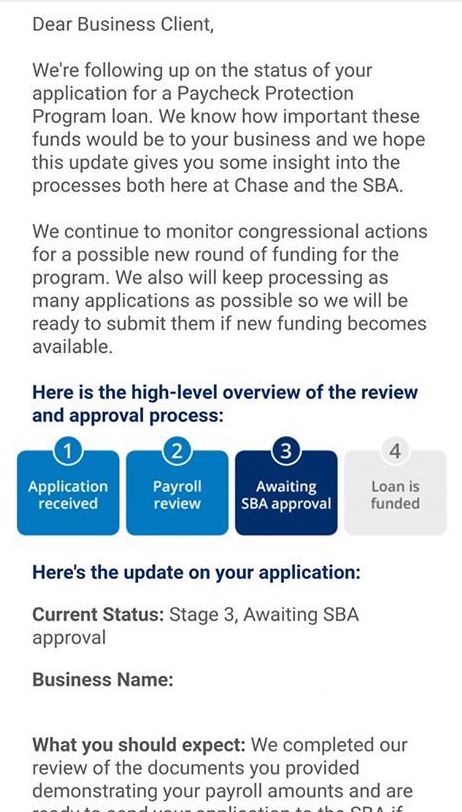

PPP Loan Status

You’ll need to contact your bank or lender. Many banks are just directing customers to their online portal or dashboard because they’re overwhelmed with applications, so if you have a direct business banker or lender contact, use that connection. Some Chase customers receive an email indicating their status in the process, like this one:

You’ll need to ensure you provide documentation of your payroll via through one of these common formats:

- payroll processor records

- payroll tax filings

- Form 1099–MISC

- income and expenses from a sole proprietorship

- other supporting documentation, such as bank records, sufficient to demonstrate the qualifying payroll amount

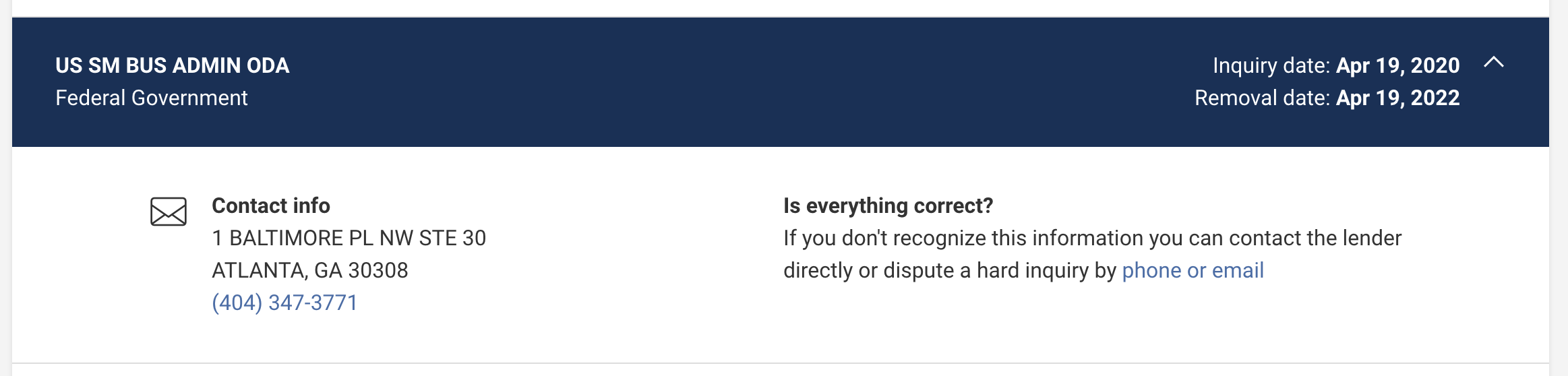

EIDL Advance & Loan Status

For EIDL loans, many small businesses don’t find out they’re receiving the advance until they see (1) a credit pull/inquiry on their Experian credit report

and then (2) a deposit hit their business account

Shortly after that, you get login information to the SBA portal and documentation, but various reports from small businesses and contacts at the SBA indicate it may take one to three weeks for the loan to be approved and loan documentation provided after the advance is received (because of the large volumes being processed).

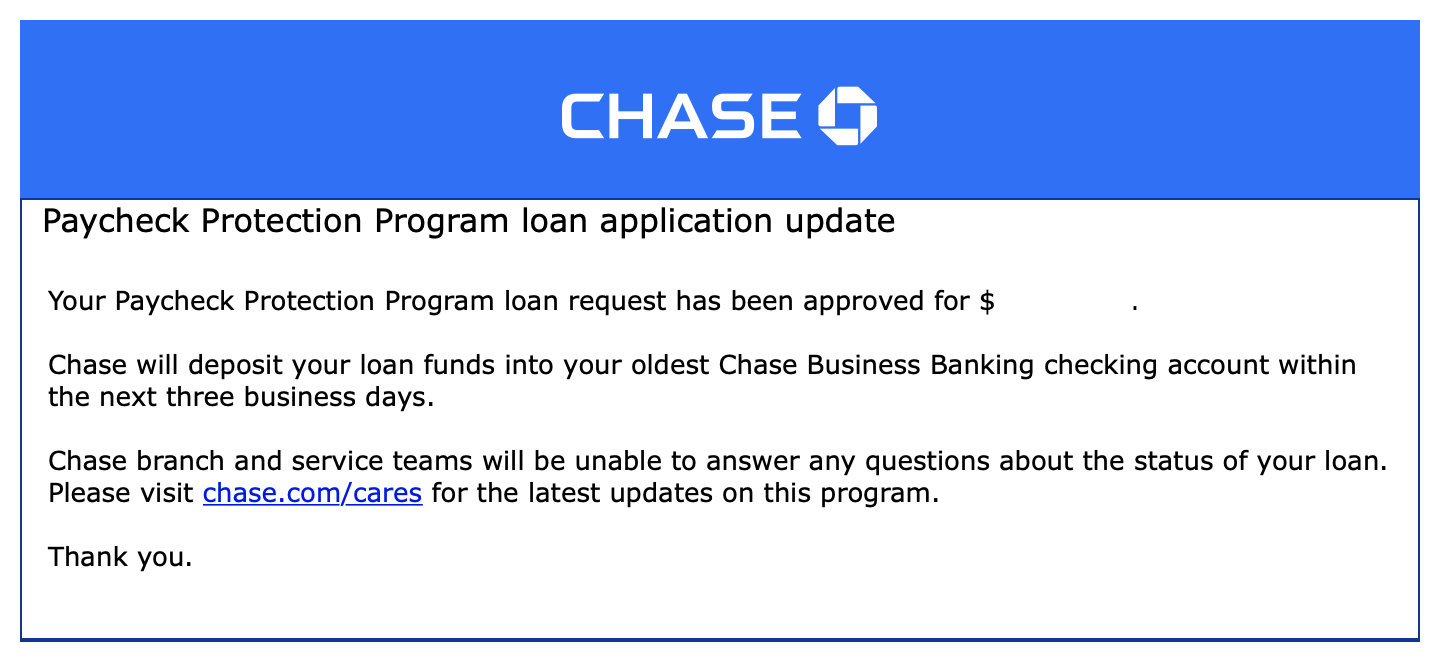

I Got a PPP Loan… What Next?

If you received a PPP loan, you’ll likely get the confirmation email from your lender and see the deposit in your account online, like this one from Chase:

You’ll want to make sure you track the usage of your PPP funds in order to get forgiveness. You will still have the PPP’s low-interest-rate (1%) and payments are deferred for six months, regardless, but if you can get the forgiveness that is, of course, ideal.

Chase sends out this communication to PPP recipients reminding them to know the rules and track usage of their PPP funds:

PPP Forgiveness Rules

The current guidelines for PPP forgiveness are laid out in the Interim Final Rule:

- 100% of the amount (principal and accrued interest) can be forgiven as long as (1) the loan proceeds are used for the approved forgivable purposes described below and (2) employee and compensation levels are maintained.

- The actual amount of loan forgiveness will depend, in part, on the total amount of payroll costs, payments of interest on mortgage obligations incurred before February 15, 2020, rent payments on leases dated before February 15, 2020, and utility payments under service agreements dated before February 15, 2020, over the 24-week period following the date of the loan.

Some updates were announced recently with new legislation aimed to give more flexibility and time to small businesses to use PPP loans including:

- You now have up to a 24-week Covered Period (previously this was 8 weeks) to spend loan funds starting the date loan funds were deposited into your business checking account.

- You must use at least 60% of funds for eligible payroll costs to qualify for full loan forgiveness, down from 75% from the original guidance. You can use up to 40% of funds for eligible non-payroll costs, up from 25%.

- If you apply for Forgiveness, you won’t have to start making payments until the SBA makes a decision or remits the funds. You generally have to submit a Forgiveness request within 10 months after the 24-week Covered Period ends.

- If you don’t apply for Forgiveness, you won’t have to start making payments until 10 months after the 24-week Covered Period ends.

- You may be eligible for FTE Safe Harbor provisions if you have fewer employees now.

- The SBA may put out additional guidance on loan forgiveness, so staying up to date with the latest information on the SBA website and Treasury website is important. You can see all of the SBA documentation here.

Need help making sense of the fine print and what it means for your business? Get in touch with us today to review your small business’ finances and make sure you’re tracking the expenditures properly for forgiveness.

How to Get PPP Forgiveness

In order to get your PPP loan forgiven, you will need to:

- Submit a request for loan forgiveness from your lender. The official forgiveness application is available here from the SBA, but your lender may create an online version for submitting (just as many lenders did when having you apply for a PPP) and it will be submitted to your lender.

UPDATED FORMS: The SBA also recently announced an easier option for some businesses to request PPP loan forgiveness with a revised 3508 application and a 3508EZ form. You may be able to use the EZ form if you meet one of the following criteria:

- Are self-employed and have no employees

- Did not reduce the salaries or wages of your employees by more than 25% and did not reduce the number or hours of your employees

- Experienced reductions in business activity as a result of health directives related to COVID-19 and did not reduce the salaries or wages of your employees by more than 25%

See the SBA Form 3508EZ here. The form includes instructions on it.

If you can’t use Form 3508EZ, you should still review the updated PPP Loan Forgiveness Application Form 3508 and the revised Schedule A Worksheet.

- According to the SBA, the above PPP forgiveness application has the following components: (1) the PPP Loan Forgiveness Calculation Form; (2) PPP Schedule A; (3) the PPP Schedule A Worksheet; and (4) the (optional) PPP Borrower Demographic Information Form. All Borrowers must submit (1) and (2) to their Lender.

- The request will include documents that verify the number of full-time equivalent employees and pay rates, as well as the payments on any eligible mortgage, lease, and utility obligations.

- You must certify that the documents are true and that you used the forgiveness amount to keep employees and make eligible mortgage interest, rent, and utility payments.

Your lender must make a decision on your PPP loan forgiveness within 60 days.

Ensuring forgiveness:

- You will owe money when your loan is due if you use the loan amount for anything other than payroll costs, mortgage interest, rent, and utility payments over the eight weeks after getting the loan.

- You can only spend 25% of the forgiven for non-payroll costs. You will also owe money if you do not maintain your staff and payroll.

- Number of Staff: Your loan forgiveness will be reduced if you decrease your full-time employee headcount.

- Level of Payroll: Your loan forgiveness will also be reduced if you decrease salaries and wages by more than 25% for any employee that made less than $100,000 annualized in 2019.

- Re-Hiring: You have until June 30, 2020 to restore your full-time employment and salary levels for any changes made between February 15, 2020 and April 26, 2020.

Payroll Specifics

Keep in mind that the PPP only covers up to $100,000 in payroll per employee, so you can’t pay any employee over $100,000 with the funds. That means to be safe, you’ll want to keep it below that, which is a weekly payroll amount of $1,923.07.

Tips for Tracking Your PPP Funds for Forgiveness

You’ll want to make sure you clearly track your PPP expenses in order to prove how they were used so you can get forgiveness eight weeks after you get your PPP loan. You can do this by putting ‘PPP – payroll’ or ‘PPP – mortgage’ in the memo of a check or indicate these notes in the online transfer verbiage. You can also create a separate label or account in your financial software like Quickbooks Online or any other platform you use.

It’s also a good idea to model out your projections. Many banks are using this worksheet in determining the loan amount. As you proceed through your eight-week PPP time period, you can use something similar to track how you use the funds and what your loan forgiveness amount is projected to be.

Be careful to keep detailed records – you can even attach those records to specific transactions in your accounting software – so that you can easily substantiate your spending if you need to.

Download the PPP projection and tracking worksheet here (.xls): Payroll Calculation Spreadsheet

Best Practice Tip: Take the modeling that was created in applying for the PPP loan and use it for tracking the application of the funds. That way, the business knows how the forgiveness portion is following. The SBA provided a model for banks to use in determining eligibility, which also shows how forgiveness will work. We update that model to fit better with each of our clients and then review it every week or so to make sure things are tracking as expected.

Can I Get a PPP and EIDL Loan?

Yes, but you can’t use the funds for the same purpose. So, both can’t be used to cover payroll. Also, if you got an EIDL on or before April 3, 2020, you must refinance it with your PPP loan if you get one.

Tracking PPP and EIDL Expenditures Separately

If you get both the PPP and EIDL, you just need to make sure you use them for different purposes. We recommend getting a trusted financial advisor and also use a financial tracking software like Quickbooks to clearly mark expenses.

[Request Consultation CTA]

How the EIDL Advance (Grant) Impacts PPP Forgiveness

If you get the EIDL Advance (up to $10,000, $1,000 per employee), then that amount goes against your PPP forgiveness amount. For example, if you are a sole proprietor and got a $1,000 EIDL Advance, then your PPP forgiveness eligibility amount decreases by $1,000. So, if your PPP loan was $20,000 and you received a $1,000 EIDL Advance, you’d be eligible for a total of $19,000 to be forgiven for your PPP loan.

Details on the EIDL

The specific details for spending the EIDL aren’t laid out on the SBA website like with the PPP Loan. You’ll only get the specifics when you have the loan agreement after applying.

EIDL Amounts and Fees

You’ll get an amount before confirming and signing the documents for your EIDL. Additionally, you’ll pay Uniform Commercial Code (UCC) lien filing fees and a third-party UCC handling charge of $100 which will be deducted from the Loan amount stated in your documentation.

Parameters for Spending the EIDL

The EIDL documentation lays out the following details for what you’re allowed to use EIDL funds for as well as how to document spending:

- Use “all the proceeds of this Loan solely as working capital to alleviate economic injury caused by disaster occurring in the month of January 31, 2020 and continuing thereafter.”

- Obtain and itemize receipts (paid receipts, paid invoices or cancelled checks) and contracts for all loan funds spent and retain these receipts for three years from the date of the final disbursement. Prior to each subsequent disbursement (if any) and whenever requested by SBA, Borrower will submit to SBA such itemization together with copies of the receipts.

- To the extent feasible, purchase only American-made equipment and products with the proceeds of this Loan.

What You Can’t Use EIDL Funds for

- You can’t use, directly or indirectly, any portion of the proceeds of this Loan to relocate without the prior written permission of SBA. The law prohibits the use of any portion of the proceeds of this Loan for voluntary relocation from the business area in which the disaster occurred. You’ll need to request the SBA’s prior written permission to relocate.

EIDL Recipients are Also Supposed to Maintain Hazard Insurance

Within 12 months from the date of your EIDL Loan Authorization and Agreement, the SBA requires proof of an active and in effect hazard insurance policy including fire, lightning, and extended coverage on all items used to secure this EIDL to at least 80% of the insurable value. You agree to not cancel such coverage and maintain such coverage throughout the entire term of the EIDL.

Is There a Prepayment Penalty for Paying My EIDL Early?

No, there’s no prepayment penalty. You can pay in part or in full at any time, without notice or penalty.

You must pay the monthly principal and interest payments laid out in your loan documents beginning 12 months from the date of the EIDL Note. SBA will apply each installment payment first to pay interest accrued to the day SBA receives the payment and will then apply any remaining balance to reduce principal. All remaining principal and accrued interest are due and payable 30 years from the date of the EIDL Note.

Can I Get COVID-19 Tax Credits and a PPP Loan?

No. Businesses can get an Employee Retention Tax Credit, which is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to employees between March 12, 2020 and December 31, 2020. Eligible employers can get immediate access to the credit by reducing employment tax deposits they’d otherwise be required to make. If your employment tax deposits won’t cover the credit, you may be able to get an advance payment from the IRS.

Wages (including certain health plan costs) up to $10,000 per employee can be counted towards the amount of the 50% credit. This credit can apply to wages already paid after March 12, 2020, so you can get access to this credit by reducing upcoming deposits or requesting an advance credit using Form 7200, Advance of Employer Credits Due To COVID-19.

You’ll have to decide which option makes the most sense for you, though, (Tax Credit or PPP loan) because if you receive a PPP loan, you’re not eligible for the Employee Retention Credit. There are some other stipulations to know about related to what wages are included and can be counted for this credit, which are detailed on the IRS website. We can also help you understand all of your tax implications for your business and individual needs.

Other Financial Resources

Looking for other resources and financial support during this challenging time? Check out our complete COVID-19 guide here.