We’ve had a lot of clients reaching out to ask about the recent bills, announcements, and news media they’re seeing related to COVID-19 financial relief. So, we’ve compiled details here for you to help explain some of the programs available, who is eligible for them, and what you need to do to get them.

There’s a lot of rapidly changing information in today’s hectic landscape, so information is accurate as of the publication date and we’re working hard to keep this updated as best we can as new details emerge. Stay safe and healthy and if you need help understanding how your personal or business finances may benefit from any of these new options (or just to get a better handle on your finances), please reach out to us here at Kansas Money Coach for a personal consultation.

Also, in the spirit of social distancing, we offer virtual support and provide a login for all clients to our secure, helpful online portal to manage the process and organize documents.

Financial Resources & Support for Individuals & Families

The Economic Income Payment

Quick summary:

The Coronavirus Aid, Relief, and Economic Security (CARES) Act recently passed by Congress and signed by the President includes direct payments also sometimes called “recovery rebates” or “stimulus refunds” being made to individuals throughout the U.S., though there are some restrictions and details to note below.

Amount:

Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive a payment of up to $1,200 for individuals or $2,400 for married couples. Parents also receive $500 for each qualifying child.

Who is eligible?

These payments are targeting lower and middle-class income families, so if your income is higher you may not be getting funds via this program. To qualify for the full payment, you must be a tax filer with an adjusted gross income of $75,000 or less as an individual or $150,000 or less as a married couple filing a joint return.

For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000 (individual) and $150,000 (married couples filing jointly) thresholds. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples. Parents also receive $500 for each qualifying child.

Single filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible.

When it’s happening:

Payments have started going out (beginning mid-April), but it may take some time for everyone to get their check or have their money deposited.

How to get it:

According to the IRS, these “will be distributed automatically, with no action required for most people.” The IRS website does note that “some seniors and others who typically do not file returns will need to submit a simple tax return to receive the stimulus payment.”

The Treasury is planning to develop a web-based portal for individuals to provide their banking information to the IRS online so that individuals can receive payments immediately as opposed to waiting on checks to be mailed.

For anyone who doesn’t typically file a tax return, you will need to file a simple tax return to get this payment. Low-income taxpayers, senior citizens, Social Security recipients, some veterans, and individuals with disabilities who are otherwise not required to file a tax return will not owe tax.

You can check the status of your stimulus payment and enter your information if you’re a non-filer here on the IRS website.

The bottom line on the Economic Income Payment:

If you haven’t filed for 2019 yet, the tentative eligibility will be based on your 2018 income tax return. If you receive a check and it’s later determined you were ineligible, you’ll have to pay back the amount received. So, if you’re close to the eligibility limits, make sure you’re prepared to pay the amount back if needed.

Quick summary:

If you have student loans, federal student loan borrowers can be placed in an administrative forbearance to allow you to temporarily stop making your monthly loan payment in order to provide relief to student loan borrowers during the COVID-19 national emergency.

Amount:

There’s no specific amount, but as of March 13, 2020, the President announced that interest would be waived on all federally held student loans.

Who is eligible?

All loans owned by the U.S. Department of Education (ED) will have interest waived, which includes Direct Loans, as well as Federal Perkins Loans and Federal Family Education Loan (FFEL) Program loans held by ED.

Some FFEL Program loans are owned by commercial lenders, and some Perkins Loans are held by the institution you attended, so these loans are not eligible for this benefit at this time.

Private student loans aren’t covered because the ED doesn’t have legal authority over these, but you can also contact your loan servicer if you are concerned about making payments.

How to get it:

Touch base with your loan servicer online or by phone to determine if your loans are eligible. Your servicer is the entity you make payments to each month, but if you do not know who your servicer is or how to contact them, visit StudentAid.gov/login for assistance.

If your loans are owned by ED, they will automatically adjust your account so that interest doesn’t accrue. The account adjustment will be effective March 13, 2020, and during this period of no interest, if you continue to make payments, the full amount will be applied to the principal.

You can also ask your student loan servicer for an administrative forbearance. Being in an administrative forbearance means that you can temporarily stop making your federal student loan payments without becoming delinquent. Because interest is being waived during the COVID-19 national emergency, interest will not accumulate while you are in forbearance.

If you request an administrative forbearance, you will not have any payments due for as long as the administrative forbearance lasts and your loan servicer will cancel any scheduled auto-debit payments. After the administrative forbearance ends, you will have to resume making payments. If you wish to use auto-debit, you may restart auto-debit payments; they will not automatically resume.

The bottom line on Student Loans:

If you can afford to keep paying on your student loans, it’s a good idea to do so. This will help you continue to get closer to paying them off.

Emergency Paid Sick & Family Leave Benefits

Quick summary:

Emergency paid sick and family leave benefits are available to employees (with some limitations and exceptions) for Coronavirus-related leave through December 31, 2020.

Details on what it provides:

The Families First Coronavirus Response Act (FFCRA or Act) requires certain employers to provide employees with paid sick leave or expanded family and medical leave for specified reasons related to COVID-19.

The Department of Labor’s (Department) Wage and Hour Division (WHD) administers and enforces the new law’s paid leave requirements. Generally, the Act provides that employees of covered employers are eligible for:

- Two weeks (up to 80 hours) of paid sick leave at full pay if the employee is unable to work because the employee is quarantined (because of a Federal, State, or local government order or the advice of a healthcare provider), and/or experiencing COVID-19 symptoms and seeking a medical diagnosis.

- Or two weeks (up to 80 hours) of paid sick leave at two-thirds of their pay rate because they’re unable to work due to a bona fide need to care for an individual subject to quarantine (a Federal, State, or local government order or the advice of a health care provider), or to care for a child (under 18 years of age) whose school or child care provider is closed or unavailable for reasons related to COVID-19, and/or the employee is experiencing a substantially similar condition as specified by the Secretary of Health and Human Services, in consultation with the Secretaries of the Treasury and Labor.

- Up to an additional 10 weeks of paid expanded family and medical leave at two-thirds the employee’s regular rate of pay where an employee, who has been employed for at least 30 calendar days, is unable to work due to a bona fide need for leave to care for a child whose school or child care provider is closed or unavailable for reasons related to COVID-19.

How to get it:

Get the specifics related to the calculation of pay here on the DOL website.

Unemployment Insurance During COVID-19

Quick summary:

If you’ve been laid off due to issues stemming from COVID-19, the U.S. Department of Labor recently announced new guidance on March 12, 2020, outlining flexibilities that states have in administering their unemployment insurance (UI) programs to assist Americans affected by the COVID-19 outbreak.

Who is eligible?

Federal law permits significant flexibility for states to amend their laws to provide UI benefits in multiple scenarios related to COVID-19. For example, states can pay benefits where:

- An employer temporarily ceases operations due to COVID-19, preventing employees from coming to work.

- An individual is quarantined with the expectation of returning to work after the quarantine is over

- An individual leaves employment due to a risk of exposure or infection or to care for a family member. In addition, federal law does not require an employee to quit in order to receive benefits due to the impact of COVID-19.

How to get it:

You’ll need to connect with your specific state’s unemployment insurance program.

The Paycheck Protection Program (PPP)

Quick summary:

The Paycheck Protection Program (PPP) is a loan program designed to provide a direct incentive for small businesses to keep their workers on their payroll. The SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities. This program is available through June 30, 2020, but they’re issued on a first-come, first-serve basis so it’s in your best interest to apply as soon as possible when loans open up.

Amount:

Up to a $10 million small business loan for payroll and certain expenses.

Your business’s specific loan amount will = your average monthly payroll (for 2019) X 2.5.

Who is eligible?

You can apply if your small business has less than 500 employees (including sole proprietorships, independent contractors and self-employed persons) or is a private non-profit organization or 501(c)(19) veterans organizations affected by Coronavirus.

Additionally, businesses in certain industries may have more than 500 employees if they meet the SBA’s size standards for those industries. Small businesses in the hospitality and food industry with more than one location could also be eligible at the store and location level if the store employs less than 500 workers, so each store location could be eligible.

Do you have to pay it back?

If all employees are kept on the company’s payroll for eight weeks, the SBA will forgive the portion of the loans used for payroll, rent, mortgage interest, or utilities. Up to 100% of the loan is eligible for forgiveness.

Additional details to know about the PPP:

It’s important to know the specifics of this program to ensure you follow the guidelines, including:

- The amount that eligible recipients may qualify is determined by eight weeks of prior average payroll plus an additional 25% of that amount.

- Terms: Loan payments will be deferred for six months, though interest will accrue over this time. This loan has a maturity of two years and an interest rate of 1% (this is an update from the originally announced .5% interest amount). There are no prepayment penalties or fees.

- If you maintain your workforce, SBA will forgive the portion of the loan proceeds that are used to cover the first eight weeks of payroll and certain other expenses following loan origination.

- The loan will be fully forgiven if the funds are used for payroll costs, interest on mortgages, rent, and utilities (due to likely high subscription, at least 75% of the forgiven amount must have been used for payroll).

- No collateral or personal guarantees are required. Neither the government nor lenders will charge small businesses any fees.

- Forgiveness is based on the employer maintaining or quickly rehiring employees and maintaining salary levels. Forgiveness will be reduced if full-time headcount declines, or if salaries and wages decrease.

- If you’re self-employed: While the information is a tad sketchy as it relates to payroll for the self-employed, it appears that amounts (up to the $100K cap) on which self-employment tax was paid qualifies.

- You will owe money when your loan is due if you use the loan amount for anything other than payroll costs, mortgage interest, rent, and utility payments over the eight weeks after getting the loan. You will also owe money if you do not maintain your staff and payroll.

- Number of Staff: Your loan forgiveness will be reduced if you decrease your full-time employee headcount.

- Level of Payroll: Your loan forgiveness will also be reduced if you decrease salaries and wages by more than 25% for any employee that made less than $100,000 annualized in 2019.

- Re-Hiring: You have until June 30, 2020 to restore your full-time employment and salary levels for any changes made between February 15, 2020 and April 26, 2020.

How to get it:

Here’s the PPP application so you know the type of information you’ll need to provide when applying. You can either complete this or you may need to complete an online application, depending on your lender. The Department of Treasury’s detailed borrower’s guide is available here as well.

You can apply through any existing SBA 7(a) lender, federally insured depository institution, federally insured credit union, and Farm Credit System institution that is participating. Other regulated lenders will also be available to make these loans once they are approved and enrolled in the program.

Dates you can begin applying:

- Some lenders begin processing loan applications as soon as April 3, 2020 for small businesses and sole proprietors.

- Beginning April 10, 2020, independent contractors and self-employed individuals can apply for and receive loans to cover their payroll and other certain expenses through existing SBA lenders.

Other regulated lenders will be available to make these loans as soon as they are approved and enrolled in the program. So, check with your local lender or a 7(a) lender on the SBA website to see whether it is participating in the program and if so, when you can apply for it.

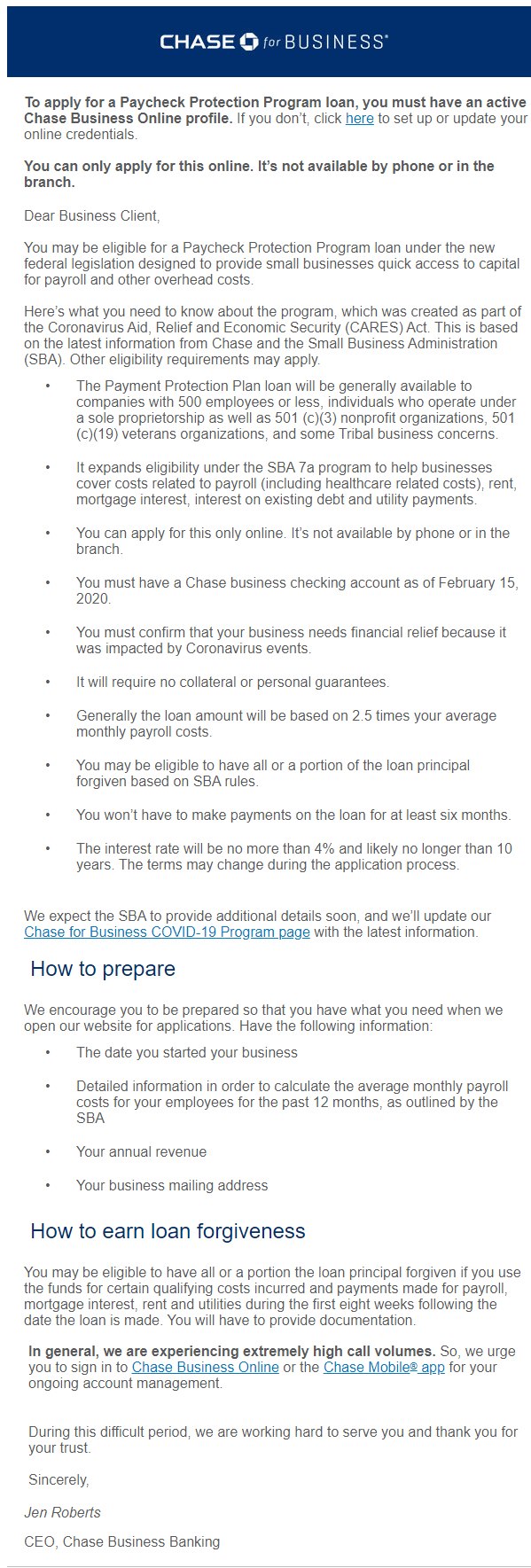

Some banks like Chase have sent out communications to small business customers letting them know that they’ll have access to PPP loans as current customers:

Chase also has a landing page where it’s providing updates for customers and even offering webinars on how to leverage the SBA’s PPP.

The bottom line on the PPP:

While business loans aren’t generally something we recommend rushing out to get, in extreme circumstances like today’s, this unique option can be a helpful source of missing income to help stay afloat especially with its forgiveness options if you follow the outlined guidelines. But, be mindful of the requirements. If they’re not followed, the loan won’t be forgiven and you’ll be forced to pay it back. So, you’ll need to be prepared to document how the funds were spent.

COVID-19 Economic Injury Disaster Loans (EIDL) and Loan Advance

Quick summary:

Small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance in response to COVID-19.

Amount:

The loan advance amount goes up to $10,000 ($1,000 per employee up to the $10,000 maximum). The SBA’s Economic Injury Disaster Loan program also provides small businesses with low-interest loans of up to $2 million to help overcome the temporary loss of revenue associated with COVID-19.

Who is eligible?

Small business owners in all U.S. states and territories are currently eligible to apply for a low-interest loan due to Coronavirus. Eligible non-profits, Veterans organizations, Tribal concerns, sole proprietorships, self-employed individuals, and independent contractors described in the Small Business Act with 500 or fewer employees may apply.

Additionally, some businesses in certain industries may be able to apply if they have more than 500 employees (if they meet the SBA’s size standards for those industries).

For Economic Injury Disaster Loans, the interest rate is 3.75% for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for non-profits is 2.75%.

You are also able to get both the EIDL and PPP loans, though they can’t be used for the same purpose.

Do you have to pay it back?

The loan advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within a few days of a successful application (previously this was listed on the website as being available in three days, but several business owners who have applied have reported not yet receiving any information or funds). Delays are being reported as there are a large number of businesses applying, so getting your application in ASAP is recommended. This loan advance will not have to be repaid.

The Disaster Loan does have to be paid back based on the confirmed terms after you apply and accept the loan.

What you need to do to get it:

You can apply for the Loan Advance and EIDL here on the SBA website.

Quick summary:

The Families First Coronavirus Response Act (H.R. 6201) was signed into law on March 18, 2020. It includes refundable tax credits for employers who provide paid sick leave or family or medical leave for their employees who miss work for various Coronavirus-related reasons through December 31, 2020.

Who is eligible?

It is subject to limitations and exceptions, but in general, employers of less than 500 employees are required to provide mandatory sick time and paid family leave. However, they are eligible for payroll tax credits to offset the costs.

How does it work?

The bill provides an employer with a payroll tax credit equal to 100% of the qualified family leave wages paid by them.

It requires employers with fewer than 500 employees to provide public health emergency leave under the Family and Medical Leave Act when an employee is unable to work or telework due to a need for leave to care for a son or daughter under age 18 because the school or place of care has been closed, or the childcare provider is unavailable, due to a public health emergency related to COVID-19.

The paid leave is available for up to 10 weeks, though the first 10 days of the leave may consist of unpaid leave. However, the employee may choose to use any accrued paid time off.

The amount paid per day is calculated based on the “two-thirds rule” discussed in H.R. 6201. The credit is generally available for up to $200 in wages for each day an employee receives qualified family leave wages. A maximum of $10,000 in wages per employee would be eligible for the credit. Additionally, the paid leave benefit is available to self-employed taxpayers.

Employers with fewer than 50 employees can be exempted from the requirement and healthcare providers and emergency responders can be excluded from this rule.

Detailed information:

Get additional details on the specific benefits here on the Department of Labor website.

SBA Debt Relief

In addition to these new programs, The SBA Debt Relief program will provide a reprieve to small businesses as they overcome the challenges created by this health crisis by paying the principal and interest of:

- new 7(a) loans issued prior to September 27, 2020

- any current 7(a) loans for a period of six months

SBA Express Bridge Loans

Quick summary:

The Express Bridge Loan Pilot Program can help small businesses get quick access to funds with less paperwork in order to help overcome the temporary loss of revenue they are experiencing and bridge the gap while applying for a direct SBA Economic Injury Disaster Loan (EIDL).

Amount:

Up to $25,000

Who is eligible?

Small businesses who currently have a business relationship with an SBA Express Lender

How does it work?

The bridge loan will be repaid in full or in part by proceeds from the EIDL. You can find an Express Bridge Loan Lender by connecting with your local SBA District Office.

Tax Relief & Filing Your Taxes

Federal Tax Relief

If you’re going to owe money or still need to compile information to file taxes, you have a bit more time now. The IRS announced on March 21, 2020 that it has extended the federal filing and payment deadline 90 days beyond the original deadline — making the new deadline July 15, 2020 for filing your 2019 taxes. First-quarter estimated tax payments are also extended for 90 days as well.

State Tax Relief

Most states have also extended their deadlines as well — 37 states including Kansas now have the same July 15, 2020 deadline for filing and paying 2019 state taxes. Your best bet is to check with your state tax administration for specifics and details or touch base to let us help you navigate the changing tax landscape.

What if You’re Expecting a Tax Refund?

If you’re expecting a refund, you can still file now (and should!). The IRS currently notes that most refunds are still being issued in approximately 21 days and that providing your direct deposit information is the fastest way to receive a refund. Kansas Money Coach can help you understand all the ins and outs of your taxes as well.

What if You Need Even More Time to Pay My Taxes?

If you need more time in addition to the July 15 deadline, you can file an extension using Form 4868 (for individuals) or Form 7004 (for businesses).

Are Second Quarter Payments Deferred as Well?

The second-quarter tax payments normally due June 15, 2020, aren’t addressed in the relief granted by the IRS, so those are currently still due on that date.

Other Financial Resources & Programs

There are some other options as well, including some private entities and organizations who are supporting others. Some examples include:

Local State and City Loans & Funds

You may want to check with your state or city to see if they have any support available for local small businesses. For instance, the National Apartment Association (NAA) notes on their website that some cities are doing their part to help provide assistance while companies wait for more robust financing. Cities including Austin, Boston, Denver, Kansas City, and more are rolling out programs to try to supplement and keep small businesses open in their communities.

Facebook Small Business Grants Program

Facebook is supporting small businesses that may be experiencing disruptions resulting from the global outbreak of COVID-19 with financial support. They’re going to provide $100M in cash grants and ad credits for up to 30,000 eligible small businesses in over 30 countries where they operate.

They’re still finalizing the details of the program, but you can sign up on their website here to get email updates as more information becomes available.

Facebook also has some resources for small businesses to promote their brands and companies here on their website.

The James Beard Foundation Food and Beverage Industry Relief Fund

The James Beard Foundation recognizes the dire situation the food and beverage community is in due to the COVID-19 pandemic. Their fund provides critical financial assistance to small, independent restaurants that, due to the COVID-19 (Coronavirus) national disaster, have an immediate need for funds to pay set operating expenses and keep from going out of business.

Restaurants, bars, and other independent food and beverage operations are strong economic drivers with the culinary industry generating $1 trillion in revenue per year, or 4% of U.S. GDP. The food and beverage community also employs nearly 16% of the American workforce.

Due to an overwhelming response and a large number of applications, they had to close the first round. However, you can stay up to date with future opportunities on their website.

The U.S. Chamber of Commerce Foundation has additional financial assistance resources for small businesses including other loan and grant opportunities listed here on their website.

Watching Out for COVID-19 Scams

Scammers are unfortunately out in full force right now trying to get money from individuals and business owners — preying on people who are looking to get information and financial support. A few key things to note:

- Don’t click in links in emails requesting personal information, passwords, or your Social Security number. Phishing scams are common and emails from scammers can often look legit, mimicking banks, the IRS, and other organizations. If you notice odd wording or lots of typos, that can be an indicator of a scam. Also, you can always check the sender’s email address to ensure the domain name matches the company listed in the email.

- Some news outlets are reporting scammers calling to request personal information in order to confirm in order to receive your economic income payment. You will not receive calls from the federal government or IRS to verify the information for these stimulus payments or to collect IRS payments. Often these scammers leverage the fact that people are scared they won’t receive money or may get in trouble for not paying their taxes.

- For Kansas residents concerned about possible scams, the Kansas Attorney General has an online form to submit any Coronavirus and price gouging scams you’d like them to investigate. Complete the form here.

How Kansas Money Coach Can Help You

As the Coronavirus (continues to affect many of us — our clients, local communities, and global economies — we want you to know that we’re dedicated to helping you maintain your finances and business continuity.

We remain committed to helping you even when meeting in person isn’t feasible. So, touch base with any questions anytime!

Additional Resources

Individuals & Families

- The IRS website

- U.S. Department of Labor website

- Details on Unemployment Insurance on the DOL website

- Kansas’ Unemployment Insurance Program website to file a UI claim online or check the status on a claim

- State of Kansas Department of Labor website

- Tips from Money Done Right on what to know about Coronavirus Unemployment Insurance benefits

- I Heart Budgets’ guide to financial resources for those who need Coronavirus relief

Small Business Owners

- SBA website with Coronavirus Small Business Guidance and Loan Resources

- Details on the SBA website on the PPP

- U.S. Department of the Treasury Borrowers Detail Sheet, Website, and Interim Final Rule announcing the PPP

- U.S. Chamber of Commerce Coronavirus Emergency Loans Small Business Guide & Checklist

- Department of Labor website

- Small business owner’s guide to the CARES Act

- State of Kansas Department of Labor website

- Details on Unemployment Insurance on the DOL website

- A Forbes article on getting cash for your small business through the CARES Act

- A firsthand account on Part Time Money from a business owner on how to leverage the PPP

- An article on Nav.com on if you’ll qualify for loans as part of the CARES Act

Avoiding COVID-19 Scams

- FTC website with tips on avoiding Coronavirus scams

- The IRS website with information on tax scams and consumer alerts

- Resources from the FBI to avoid COVID-19 scams

(Originally published April 1, 2020)